WHAT WE DO?

Valar2010 MBT Sirkazhi firmly believes that sustainable development involves the simultaneous pursuit of economic prosperity, environmental quality, and social equity. So it does lots of development activities for its women members and to the general public in their working areas by involving and guiding them besides focusing only economic empowerment among its group members. In fact this helps them to build relationships and strengthen their trusts.

Social Empowerment Activities

- Creating awareness about various Government welfare schemes and entitlement programmes available at village level - help people to avail benefits like ration cards, old age pension, Aadhaar card and linking it with their bank accounts to avail LPG gas subsidy etc.,

- Encouraging its group members to participate at Gram Sabha meetings

- Mobilising women in their respective areas and help them to meet Government officials - starting from Village Administrative Officers, Panchayat leaders and other Taluk level and District level officers for their pressing issues

- Provides awareness among its group members in their weekly meetings about environment, cleanliness, health and hygiene

- Organising women into self help groups and promotes joint liability groups

- Encouraging savings among its groups members

- Providing trainings to group members (both SHGs & JLGs) about book keeping, group management and leadership sessions

- Providing Entrepreneurship skill trainings to select women members - Identifying local business opportunities, interacting with experts, skill trainings and arranging finance

- Social Security Scheme is provided to all members of SHGs/JLGs and benefits like life cover for member and their nominees, pregnant women and new born baby support and higher education support for the member families are provided; During this year

| Social Security Scheme |

# Members Benefited During 2016 - 17 |

| Credit Life Cover Support | 12 |

| Funeral Expenses Support | 32 |

| Child Birth Support | 36 |

Economic Empowerment Activities

Valar2010 MBT followed the proven way to empower women economically in rural India by establishing Self Help Groups (SHGs) and providing microcredit to them. Women from the marginalized section of the community get together and form SHGs, which help them in times of need - emergency, disaster, socioeconomic disruptions. Microcredit has been directed at women because women's access to microcredit has more desirable development outcomes, since women tend to spend more money on basic needs compared to men and there are measurable improvements in child nutrition and education, family health and household sanitation, shelter and general welfare.

Microcredit is truly a win-win proposition for economic development, boosting income and adding jobs for individuals especially women, diversifying the regional economy while lowering government support costs, reducing donor dependency and increasing government revenues. The importance of small business to the health of the economy, especially in difficult times, brings home the potential for microcredit to assist people in turning challenges into opportunities.

Valar2010 MBT Sirkazhi provides bank linkages to all its group members and helps them to avail bank credits besides its own lending.

Product

Valar2010 MBT has adopted the Joint Liability Group (JLG), a time tested method of lending best suited to the local context. At present it has one product called IGL - Income Generation Loan which is a group lending programme for women organised into a group of five members. The loan repayment term is 12 months which the borrower can pay it in monthly/fortnightly/ weekly installment as per her choice.

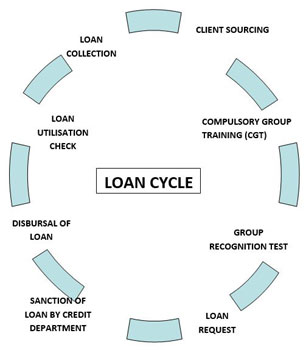

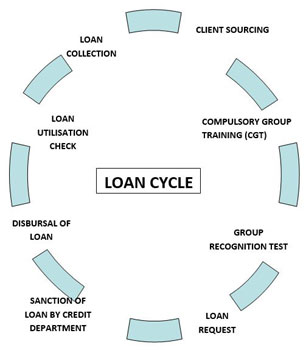

Loan Cycle

Valar2010 MBT will train all its JLG members at the formation for a 3 day "Compulsory Group Training (CGT)" wherein they teach about microfinance operations and instill the financial discipline among its members. Each group would be given loan after doing scientific assessment of their credit worthiness and the type of enterprise initiative based on a Group Recognition Test (GRT) with a set of criteria developed for members, group functioning, centers consisting of more than a group and other stipulated norms for microfinance.

Looking for Business Partners

Looking for Business Partners